Product Liability Insurance

- Meet Retailer Requirements – Get coverage trusted by top stores and marketplaces

- Shield Against Lawsuits – Protection from product defects and customer injuries

- Grow with Confidence – Unlock coverage for every stage of the supply chain

Why Do Small Businesses Need Product Liability Insurance?

Regardless of your role in the supply chain — manufacturer, retailer, distributor, wholesaler, or importer — you could face legal action if a product you sell harms someone. Strict liability laws mean you can be held responsible for injuries, property damage, or financial losses even without negligence.

A single lawsuit can drain your business’s finances, disrupt its operations, and even lead to closure. Here’s how product liability insurance can safeguard your business:

♦ A major retailer requests proof of insurance.

Without it, you risk losing shelf space or account access. Insurance ensures compliance and maintains your reach.

♦ A defect in a product you manufacture causes injury, and the customer sues.

Your policy covers legal fees and settlement costs.

♦ A customer is injured using a product you sold, even though you didn’t make it.

You’re still named in the lawsuit, and your insurance helps cover defense fees.

♦ A faulty shipment you distributed causes property damage at multiple locations.

Your policy covers the claims by paying for the repairs, keeping your operations running smoothly.

♦ A product you import is mislabeled, leading to a customer’s adverse reaction.

Insurance covers the patient’s treatment costs, even if the issue originated with the manufacturer.

What Is Product Liability Insurance?

Product liability insurance helps protect your small business from paying out-of-pocket for claims related to injuries or property damage caused by the products you sell, manufacture, distribute, or import.

Your business has a responsibility to provide safe products to consumers. If a product causes harm — whether due to your mistake or not — the consequences can be severe. You may face legal action or be required to pay thousands in compensation, which could devastate your finances and put your business at risk.

Small businesses often encounter difficulties securing sufficient product liability coverage through home or renters’ insurance. Almost all home or renters’ insurance policies do not cover product-related liability; in fact, most of these policies specifically exclude business-related activities. Our coverage offers the required protections.

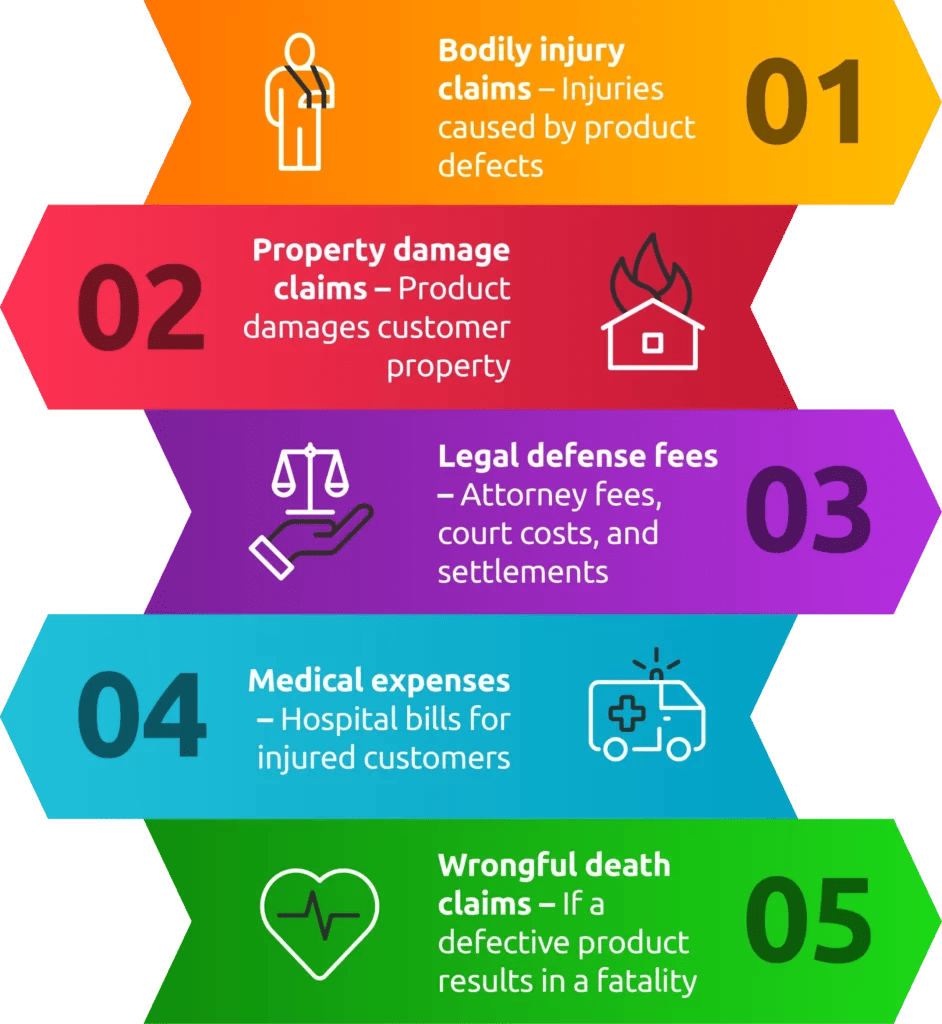

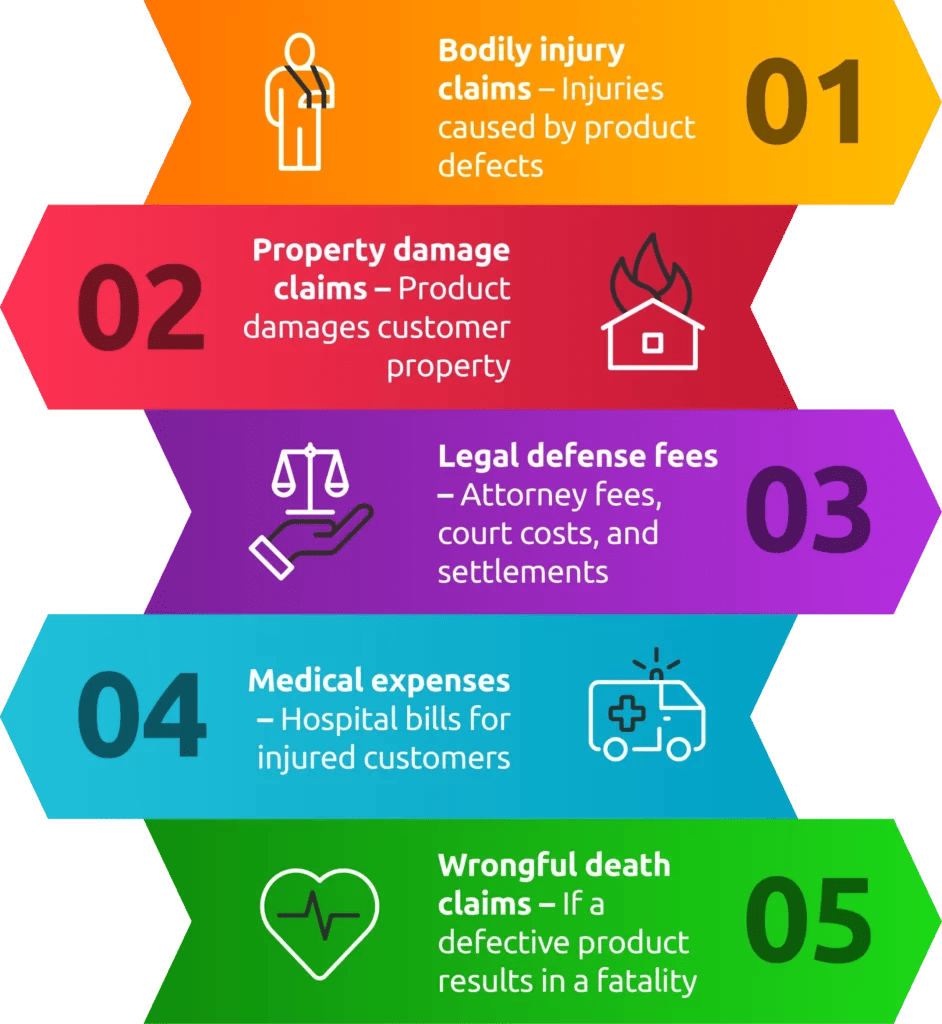

What Does Product Liability Insurance Cover?

Product liability insurance covers claims for bodily injury or property damage caused by defective or faulty products (even if you didn’t cause the error).

This includes:

- Product injuries

- Medical expenses

- Wrongful death claims

- Legal defense fees

It also provides coverage for online sales and trade shows. Additionally, it includes general liability insurance to protect you from common slips, trips, and falls.

While it’s not legally required, having coverage is a smart move for any business involved in bringing products to market.

What Does Product Liability Insurance Not Cover?

The following items are typically excluded by a product liability policy:

- Product recalls (can be added on as recall insurance)

- Employee injuries (can be added on as workers compensation)

- Professional Liability (available if you offer classes or workshops)

- Intentional misconduct or known defects

- Intellectual property claims

- Discontinued products coverage

- Cyber liability & data breach coverage (can be added on as cyber liability insurance)

- Commercial auto insurance (can be added on)

- Tool, gear, and property in transit (can be added on as inland marine insurance)

Do your operations fall under an exclusion, or do you have questions about product coverage? Our specialists are here to help you find a solution. Reach out today to explore options and secure the protection you need.

Additional Insurance Coverage You May Need

Depending on your products, business setup, or retail contracts, you may need more than product liability coverage. These add-ons help fill the gaps:

Once you submit your application, an agent will carefully review your details and reach out to discuss your business’s unique needs and recommend the most appropriate coverage options.

Have questions or want to explore your options? Don’t hesitate to contact us — we’re here to help.

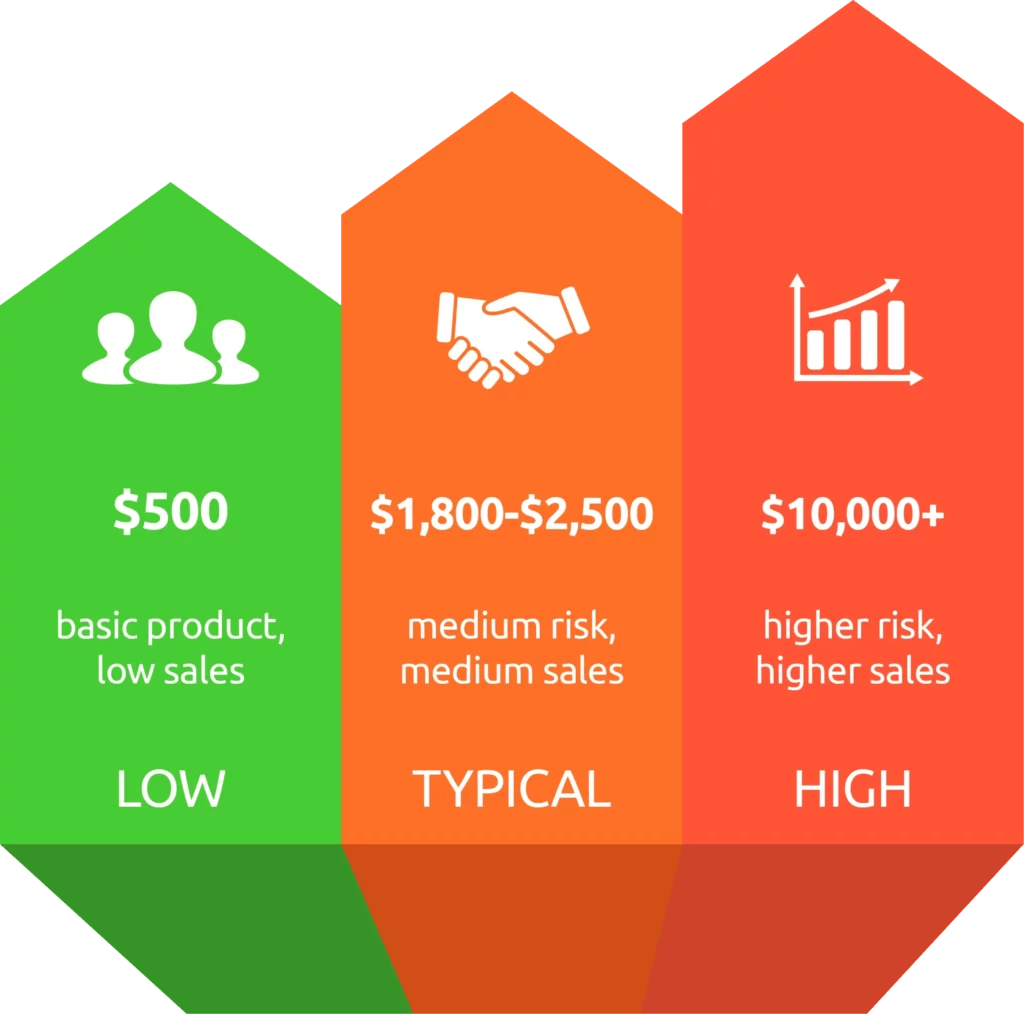

How Much Does Product Liability Insurance Cost?

On average, product liability insurance costs between $700 to $3,000 per year. However, your total premium amount depends on your product, sales volume, risk level, and additional coverage types added.

Factors That Impact Your Premium

- Business Type – Manufacturers and high-risk industries pay more than online sellers or lower-risk operations

- Product Risk – Products like supplements or medical devices may require more coverage

- Annual Sales – The more you sell, the more exposure you have

- Coverage Limits – Higher limits and added coverage (endorsements) raise your premium

- Claims History – A history of claims can raise your rate

- Contract Requirements – Retailers or partners like Amazon may require higher coverage limits, impacting your cost

Each business is unique, and your premium will be tailored to your specific needs. Credits and discounts are available (upon qualifying) and can be discussed with one of our agents.

Who Needs Product Liability Coverage?

Product liability coverage is essential for anyone involved in the creation, sale, or distribution of a product — not just for manufacturers. Whether you’re designing, manufacturing, packaging, marketing, or selling, you can be held responsible if a product causes injury or property damage.

Don’t assume the manufacturer’s policy protects you. If you’re a retailer, distributor, importer, or private labeler, you’re also at risk. From the moment a product is conceived to when it reaches the consumer, every stage carries potential liability, making product liability insurance crucial along the entire supply chain.

Real Businesses We’ve Helped Cover

Here are a few real-world examples of businesses we’ve recently helped insure:

- A startup developing wireless medical devices for pediatric patients

- A home-based creator 3D-printing flower vases and tabletop toys

- A pet brand launching natural supplements and chewables

- An importer bringing gourmet sugar and small-batch tequila to the U.S. market

- A tool company building air tools for commercial trucks

- A specialty retailer selling cooling garments for high-heat environments

- A food business manufacturing edible cookie dough and gourmet sauces

- A family-owned shop crafting handmade bath bombs and beauty items

- A direct-to-consumer brand offering baby sleepwear and accessories

If they needed small business coverage, chances are you do, too. Let’s make sure you’re protected.

Common Questions about Product Liability Insurance

How much product liability insurance do I need?

The amount of product liability insurance you need depends on the nature of your business, industry risks, and any contractual requirements. The industry standard is typically $1 million per occurrence and $2 million in total (aggregate) coverage.

However, you may need higher coverage if your business involves high-risk products like medical devices, electrical appliances, or powered hand tools. Additionally, retailers, distributors, and online platforms like Amazon may have specific coverage limits required for partnerships.

We offer higher coverage limits — such as $2 million per occurrence with a $2 million aggregate, or $3 million per occurrence with a $3 million aggregate — based on your specific needs. If your business requires more than $3 million in coverage, we may be able to create a customized solution on a case-by-case basis.

Unsure how much coverage you need? Our team is here to help you find the right fit. Give us a call!

Is product liability included in general liability?

Yes, a general liability insurance policy typically includes some product liability coverage. General liability covers bodily injury and property damage caused by your business operations, including harm caused by your products.

But if you sell high-risk items, need higher limits, or work with retailers that require specific terms, you may need a standalone product liability policy like the one we offer. Always review your policy details to ensure you have adequate protection.

Do I need product liability insurance if I only sell products online?

Yes. Even if you only sell products online, you still need product liability insurance. E-commerce platforms like Amazon and Walmart often require sellers to carry coverage, and you can still be held liable if a product you sell causes injury or property damage.

Whether you’re a dropshipper, private label seller, or reseller, you can face lawsuits for defective products, misleading instructions, or missing safety warnings. Product liability insurance helps protect your business from costly legal claims, even if you never physically handle the products you sell.

Is product liability only for manufacturers?

No, product liability insurance isn’t just for manufacturers — it’s crucial for any business involved in bringing a product to market. Whether you sell, distribute, package, import, or brand a product, you can be held responsible if it causes harm.

Many assume a manufacturer’s policy will cover them, but that’s rarely true. If a product you sell leads to injury or property damage, you could face costly lawsuits, recalls, or lost business opportunities. Manufacturer policies often won’t protect you, so having your own coverage is key.

Related Articles

Product Liability Insurance Explained: Coverage, Cost, and FAQs

When you sell a product, you’re also taking on responsibility for what happens

A Small Food Brand’s Guide to Food Product Liability Insurance

You make great food, maybe even the best. But here’s the uncomfortable truth:

Product Liability Insurance for Wholesalers: Why You Need It (Even If You Don’t Think You Do)

A day in the life of a wholesaler: boxes in, boxes out, retailers