Protecting your business dream — and all the hard work you put into it — starts with small business insurance. This coverage gives you peace of mind to pursue your passion, meet legal requirements, and secure financial protection against infinite what-ifs.

But shopping for small business coverage? It can be the most dreaded task on your to-do list, especially with the obscure pricing and complicated applications insurance is known for.

Here at Insurance Canopy, we’re all about demystifying small business insurance. Covering your business doesn’t have to be hard! We’re breaking down everything you need to know about the best small business insurance providers so you can shop confidently.

Factors to Consider When Shopping for the Best Small Business Liability Insurance

You’re not alone if you feel jaded about business insurance. Only 55% of U.S. customers say they plan to renew their current insurance in 2025, with millennials having the largest drop.

But here’s the truth: covering your business can be easier than forming your LLC or picking a new brand logo if you know what to look for. Here are the main factors to consider when comparing the best small business insurance providers.

Cost

How Insurance Canopy Does It:

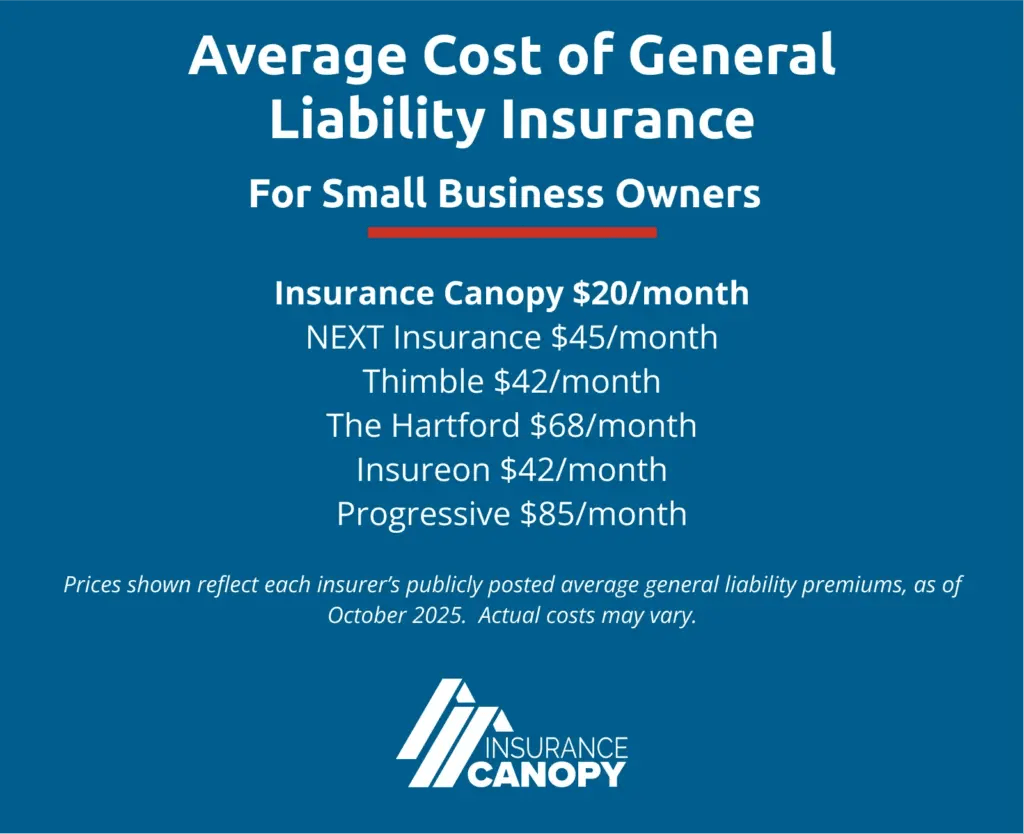

General liability insurance from Insurance Canopy ranges from $10 to $99 a month, and the average cost our policyholders pay is $20 a month for coverage.

Coverage

The next facets to look for are the scope of coverage (as in, the types of insurance offered or bundled) and the coverage limits available. Some base policies may leave gaps in protection, leaving you exposed to professional liability claims (for example, if your professional advice backfires) or loss of your business tools and equipment.

Or, their coverage limits (the maximum amounts the insurer will pay out for claims) may be significantly lower than other policies at similar price points.

How Insurance Canopy Does It:

We offer optional add-ons to your base policy so you can tailor your coverage. For example, a fitness professional’s base policy comes standard with general and professional liability insurance, with coverage add-ons for business gear, cyber liability, and more.

Ease

Today, small business insurance you can buy and edit online is non-negotiable. Your side hustle or startup moves fast, so your coverage needs to be accessible on your smartphone or tablet at the click of a button. And, no one has time for a quote to hit your inbox in a few days!

Look for an insurance policy you can buy 100 percent online, with automatic renewals, an online claims filing process, and flexible payment options.

How Insurance Canopy Does It:

Insurance Canopy’s experience is built for the modern small business owner. So, our policies check all the boxes: get a quote and buy, edit your policy, file a claim, and automatically renew — all online.

For many industries, you can get covered in under 10 minutes and download instant proof of insurance (certificate of insurance).

Customer Support

As a business owner yourself, you know how crucial it is to offer real, friendly service to your customers, without pushy sales. You should want the same from your insurance company!

Look for small business insurers with live support agents who can walk you through the entire purchasing process and answer your questions about coverage. Even though you need the ease of online insurance, sometimes it’s helpful to talk with an expert.

How Insurance Canopy Does It:

Our friendly customer support team consists of licensed, U.S.-based agents who don’t work on commission. That means we’re simply here to help you get the coverage you need.

Trust

Purchasing small business insurance is like starting a new relationship, one where you must trust that your provider will be there when you need them. Though it’s difficult to gauge the exact trustworthiness of a company, start by looking at factors like customer reviews and signals like how many small businesses they insure and how many years they’ve been in business.

Regarding potential rate increases, your insurer must communicate these changes transparently and quickly, keeping you in the loop about your coverage.

How Insurance Canopy Does It:

Insurance Canopy is committed to being your small business partner, whether you’re starting, growing, or protecting your enterprise. That means we operate with open communication and transparency, knowing your coverage and small business are on the line.

Policyholders rate us nearly 5 stars on Google Reviews. We’ve been in the industry for 15 years and currently protect over 135,000 small business owners like you. Read more about Insurance Canopy.

Niche Expertise

Some insurance giants aim to cover everything, from auto to life, which means the nuances of protecting your small business can get lost in the shuffle. Opt for an insurance provider that specializes in small- to medium-sized business coverage built around your unique risks.

How Insurance Canopy Does It:

Insurance Canopy started as a small business, so we get you. Since 2010, our insurance niche has been protecting small businesses, startups, and side hustles. Our online policies have been carefully designed to cover industry pros, with their distinct needs in mind. You can feel confident your policy is truly crafted for you.

Rating

Finally, the last factor to consider when comparing the best online small business insurance is ratings, or the financial strength of an insurance company. You need an insurer who will actually pay for claims when you need the help — this criterion is often measured by an independent agency called AM Best.

As you shop, look out for these ratings. You should only consider an insurer with a rating of “A” or higher, meaning they earned an “excellent” score on their ability to meet financial obligations.

How Insurance Canopy Does It:

Your coverage is backed by A-rated carriers (never anything less!). When something goes wrong and you need to file a claim, enjoy real peace of mind, knowing you can count on your insurance coverage when it’s crunch time.

TL;DR:

Insurance Canopy:

✅ Affordable

✅ High coverage

✅ Easy, instant, and online

✅ Licensed, U.S.-based support

✅ Nearly 5-star reviews on Google

✅ Specialized small business coverage

✅ Top-rated carriers (A-rated or higher by A.M. Best)

Overview of the Best Small Business Insurance Companies

Insurance Canopy

Pros

- Specialization in small business coverage

- Buy online in minutes + instant proof of insurance

- Live U.S.-based customer support (non-commissioned)

- 24/7 online policy management via user dashboard

- Transparent, flat-rate pricing for most industries

- Most affordable coverage on the market

- Customizable policies

- Top-rated carriers

Cons

- Currently doesn’t offer a business owner’s policy (BOP)

Coverages Offered:

- General liability insurance

- Professional liability insurance

- Product liability insurance

- Liquor liability insurance

- Cyber liability insurance

- Commercial auto insurance

- Workers compensation insurance

- Inland marine (tools and equipment)

- Surety bonds

- More coverages available — speak to an agent!

NEXT Insurance

Pros

- Fast online quote available

- Mobile app for policy management

- 10% discount available for policy bundles

Cons

- Coverage is not available in all states

- Premium costs based on work, location, etc. (no flat pricing)

- Discounts apply to specific coverages only

Coverages Offered:

- BOP

- General liability insurance

- Professional liability insurance

- Commercial auto insurance

- Commercial property insurance

- Cyber liability insurance

- Product liability insurance

- Workers compensation insurance

- Employment practices liability insurance

- Inland marine

Thimble

Pros

- Coverage by the hour, day, month, or year

- Fast, self-service policy purchase online

- Option to pause coverage

Cons

- $100 transaction fee may apply

- Coverage subject to state availability

- Costs are dependent on industry, location, etc.

- May not suit more complex risks

Coverages Offered:

- BOP

- General liability insurance

- Professional liability insurance

- Commercial property insurance

- Cyber liability insurance

- Workers compensation insurance

- Inland marine

The Hartford

Pros

- Extensive offering of coverages (business, auto, home, etc.)

- Get a quote online, via a local agency, or by calling

- Small- to large-business insurance coverage available

Cons

- Some transactions are routed to agents

- More expensive premiums compared to similar offerings

- Coverage unavailable in Alaska, Hawaii, and Washington, D.C.

Coverages Offered:

- BOP

- General liability insurance

- Professional liability insurance

- Cyber liability insurance

- Workers compensation insurance

- Commercial property insurance

- Commercial auto insurance

- Inland marine

Insureon

Pros

- Multiple-carrier shopping in one application

- Easily compare multiple policies for unique classes

- Partners with top-rated insurance companies

Cons

- Not all provider options are listed on your quote

- Claims handled by your chosen carrier (experience can vary)

- Some quotes require a representative for the final purchase

Coverages Offered (Via Insurance Partners):

- BOP

- General liability insurance

- Professional liability insurance

- Cyber liability insurance

- Commercial property insurance

- Commercial auto insurance

- Commercial umbrella insurance

- Inland marine

- Business bonds

Progressive

Pros

- Broad offering with an emphasis on auto coverage

- Browse coverage by profession or state

- Get a quote online or through an agent

Cons

- Pricing based on how you buy (i.e., through an agent or directly)

- Some coverage lines are underwritten by unaffiliated insurers

- Updates to policy must be requested and may not be instant

- Must call for a copy of your COI

- Coverage is unavailable in Hawaii

Coverages Offered:

- BOP

- General liability insurance

- Professional liability insurance

- Cyber liability insurance

- Commercial auto insurance

- Workers compensation insurance

- Liquor liability insurance

- Inland marine

- Employment practices liability insurance

- Rideshare insurance

- Commercial property insurance

- Excess and surplus lines insurance

- Employee pet insurance

Some coverages may not be offered directly through Progressive.

The Best Insurance for Small Businesses by Industry

Cleaning Professional Insurance

- Best overall: Insurance Canopy

- Bundle business and auto insurance: Progressive

- Flexible coverage with potential discounts: NEXT Insurance

- Short-term coverage for part-time cleaners: Thimble

- Global coverage and multiple policy types: Hiscox

See our full Cleaning Insurance Comparison Guide for more coverage details.

Event Vendor Insurance

- Best overall: Insurance Canopy

- Top pick for artists and crafters: ACT Insurance

- Specialty food vendors insurance: Food Liability Insurance Program (FLIP)

- Offers contractual liability coverage: K&K Insurance

- Made for weddings and parties: The Event Helper

- Coverage by the hour, day, or month: Thimble

- Designed for special events: Special Event Insurance

See our full Event Vendor Insurance Comparison Guide for more coverage details.

Consultant Insurance

- Best overall: Insurance Canopy

- Major backing for established firms: Travelers

- Short-term coverage: Thimble

- Most discounts (if you qualify): NEXT

- Multi-policy needs: Hiscox

See our full Consultant Insurance Comparison Guide for more coverage details.

Personal Trainer Insurance

The top personal trainer insurance companies at a glance:

- Best overall: Insurance Canopy

- Martial arts and swim instructor coverage: PHLY (Philadelphia)

- Broad range of add-ons and commercial business bundles: NEXT

- Partnership discounts on select continuing education courses: Insure Fitness Group

- Teacher-in-training/student policies: beYogi

See our full Personal Trainer Insurance Comparison Guide for more coverage details.

General, professional, inland marine — oh my! Not sure what kind of coverage to shop for? Check out our blog What Kind of Coverage Does a Small Business Need? for a primer on the most essential small business coverages.

Quick Tips for Comparing Affordable Small Business Insurance

Try these tips to make shopping for small business insurance as painless as possible.

- Compare apples-to-apples: Standardize your quotes based on the same limits and required endorsements — otherwise, you can miss extra costs that add up fast

- List your coverage must-haves: Confirm the essentials, like general and professional liability, plus inland marine, and check for exclusions and sublimits with each insurer

- Opt for easy COIs: Look for same-day, unlimited, editable certificates of insurance you can generate yourself, without waiting for turnaround from your carrier

- Look for non-robot support: Favor U.S.-based, human support who balance friendliness and insurance expertise (Check out what Insurance Canopy policyholders say about us!)

- Match to your industry: Pick an insurer who knows your business class inside and out, covering your unique risks with a well-designed policy (See Insurance Canopy’s coverage by industry)

Common Questions About the Best Small Business Insurance

How Easy Is It to Get a Quote and Purchase a Policy Online?

With Insurance Canopy, most small business owners can get a quote and purchase a policy online in about eight minutes. We offer ready-to-buy coverage for 250+ business types.

If you have more unique business needs, our agents can create a customized quote for you in 24 hours. Either way, our modern approach to insurance will get you covered and back to business fast.

How Quickly Can I Get a COI?

After you purchase your Insurance Canopy policy, your certificate of insurance (COI) is instantly available for download. Learn more about how to get a COI for your business.

How Easy Is It to File a Claim?

File a claim easily through your Insurance Canopy online user dashboard. Simply fill out a short form with details on what happened. From there, our team confirms we received your claim in 1–2 business days, and a claims adjuster reaches out to guide you on the next steps.

Learn more about what to expect when you file a claim.

Does Coverage Include Both In-Person and Online Businesses?

For most industries, Insurance Canopy coverage protects your business both online and in person. Exact coverage depends on the specific professional services you offer, so take the time to review and understand your policy.

Check out our tips on how to read your policy like a pro.

Is It Easy to Make a Change to My Policy?

With Insurance Canopy, you can make a change to your policy easily — right through your user dashboard online, at any time. Edits like adding an additional insured or changing your payment cadence only take a few clicks.

Insurance Canopy: Small Business Insurance Made Seriously Easy

As your partner in small business, our goal at Insurance Canopy is to give you the information you need to make a confident decision. Your small business is a big deal, and protecting it with the right insurance coverage can be as simple as “click, quote, covered” with us.

After you compare options and see that we offer the most affordable, top-rated online coverage with real support when you need it, come back and get a quote! Or, ready to get back to business now? Click below to get started.

-

They provided clarity on the importance of insurance for a first time business owner in the cleaning space and provided clear insight next steps and options for coverage.

Evergreen Multiservices

February 2, 2026Extremely user friendly website, super affordable and very little time needed to apply.

Carl Sari

January 31, 2026Excellent company, Great service, the best!!!

Claudina Adams

January 15, 2026 -

Super affordable insurance for a small business like myself super happy to be able to provide this to my customers really helps of landing more gigs

Alex

January 5, 2026Really went the extra mile to find the appropriate coverage for my business.

Daisy B

January 2, 2026Canopy provided escatly what I neede to book the gig, and at a very affordable price.. Thank You!

Andy Anderson

December 22, 2025 -

Easy. Convenient. Trustworthy. Came thru in a moments notice

Eddie K

December 19, 2025Affordable liability insurance for DJ's. Easy to set up and understand. I've been with them for several years and am happy with their service.

Peter Flessas

December 14, 2025So easy to sign up. I hope I never have to use the insurance portion but most hotels require it for corporate gigs

Yuri Gonzalez

December 11, 2025 -

This company is great. They are very helpful and they have great prices for insurance options that cover what you need!

Jacob Serrano

December 6, 2025Great experience, quick and easy to understand with what I needed for my business. Highly recommend!

FrankLynn Rae

October 28, 2025Very helpful customer service! Prompt, punctual, effective! No bots or long waits to get assistance.

Maria Ciccone

October 19, 2025 -

Canopy insurance has made affordable, band insurance needed for major venues. Thank you for your fast and easy service Stan Zizka's Del Satins

stan zizka

October 5, 2025Getting a vendor policy was quick and fairly priced compared to other quotes.

Kristine Fullerton

October 3, 2025Thank you so much

Steve Monreal

July 11, 2025 -

I needed a portable policy as a yoga instructor. I found this company in an online search. Called and got details from them, was quite surprised at how affordable... Read More it would be. Then when I was ready to make my purchase, I called again. Was explained to me that everything was done online, I told the lady on the phone I didn't want to make this kind of purchase online with no guidance. She was so helpful and kind and patient! Walked me thru every page of the form and honestly didn't take long at all. Hope I never need to use the policy but nice to know I have it.

Jamie Calaway

July 4, 2025Very easy & quick experience. We got insurance in no time with no hassle. Thank you!

Robert Earnest

July 4, 2025I am glad I went with them. I needed a last minute policy to cover an event I was doing and they had exactly what I needed at a... Read More reasonable price. I definitely would use them in the future,

Deloris Pacheco

June 27, 2025 -

Very easy to renew policy

Elyce Nissinoff

June 18, 2025Representative Sarah was very helpful. Walked me through every step and not to mention the price even matched the service! Would recommend to any and everyone.

queenkiam

June 18, 2025Would have 5 starts, but not right now. This is the first time I have ever had to pay for an additional insured ever in 20 year's. They either have... Read More a way to input the information or you can call or email to request it.

Anthony Burgess

June 18, 2025 -

Very user friendly platform. Multiple options. Very good pricing. Needed liability insurance in order to secure a very good paying event for my solo tribute show. Was set up within... Read More 15 minutes and had the signed contract in my possession 30 minutes later.

Michael Riley

June 18, 2025Needed DJ insurance for Memorial Day weekend & was squared away within an hour for 2 events! Highly recommend

Jay Solis

June 18, 2025What a lovely experience I had with Insurance Canopy! Easy and fast sign up, great policy, matches my needs as a self-employed business owner. Highly recommend!

Masha Rusanov

June 18, 2025 -

great little company, with fair pricing, for entertainers who need occasional coverage. however, they have long hold times to speak to an agent, and their customer service left a little something... Read More to be desired. 🤷🏻♀️ overall, would recommend! 🙂

Gretje Angell

June 18, 2025Provides event insurance at a very reasonable price compared to other companies. Easy to purchase and provide proof of insurance.

David Fox

May 18, 2025They can help.you with the right Insurance you need, and the lowest price

Alvaro Baltazar

May 18, 2025 -

everything is excellent

Radames Martinez

May 18, 2025Extremely affordable event insurance and an easy to work with system and team that will advise you every step of the way!

Ishan Arvin

May 18, 2025Affordable for dance & yoga folk. Thumbs up!

Maia Claire

May 18, 2025

-

They provided clarity on the importance of insurance for a first time business owner in the cleaning space and provided clear insight next steps and options for coverage.

Evergreen Multiservices

February 2, 2026 -

Extremely user friendly website, super affordable and very little time needed to apply.

Carl Sari

January 31, 2026 -

Excellent company, Great service, the best!!!

Claudina Adams

January 15, 2026 -

Super affordable insurance for a small business like myself super happy to be able to provide this to my customers really helps of landing more gigs

Alex

January 5, 2026 -

Really went the extra mile to find the appropriate coverage for my business.

Daisy B

January 2, 2026 -

Canopy provided escatly what I neede to book the gig, and at a very affordable price.. Thank You!

Andy Anderson

December 22, 2025 -

Easy. Convenient. Trustworthy. Came thru in a moments notice

Eddie K

December 19, 2025 -

Affordable liability insurance for DJ's. Easy to set up and understand. I've been with them for several years and am happy with their service.

Peter Flessas

December 14, 2025 -

So easy to sign up. I hope I never have to use the insurance portion but most hotels require it for corporate gigs

Yuri Gonzalez

December 11, 2025 -

This company is great. They are very helpful and they have great prices for insurance options that cover what you need!

Jacob Serrano

December 6, 2025

Kyle Jude | Program Manager

Kyle Jude is the Program Manager for Insurance Canopy. As a dedicated program manager with 10+ years of experience in the insurance industry, Kyle offers insight into different coverages for small business owners who are looking to navigate business liability insurance.

Kyle Jude is the Program Manager for Insurance Canopy. As a dedicated program manager with 10+ years of experience in the insurance industry, Kyle offers insight into different coverages for small business owners who are looking to navigate business liability insurance.